BeneBridge360™ — Stop-Loss for the Member

Lower Costs. Higher Satisfaction.

BeneBridge360™ reduces member out-of-pocket expenses and delivers predictable savings for employers by combining built-in provider discounts, clear billing support, and supplemental protection. It integrates with ClaimsAssist™ + AdvocateAssist™, and can be paired with 5Star insurance coverage for one streamlined experience.

The Employer Challenge

- Rising employee out-of-pocket costs create financial stress and impact retention.

- Confusing bills create extra HR workload and lower employee satisfaction.

- Unpredictable savings from supplemental programs make budgeting difficult.

The BeneBridge360™ Solution

BeneBridge360™ brings guaranteed savings and active member advocacy into one platform—reducing costs without disrupting the core medical plan.

Built-In Provider Savings

Preferential rates at partner health systems are applied automatically—no employee action required.

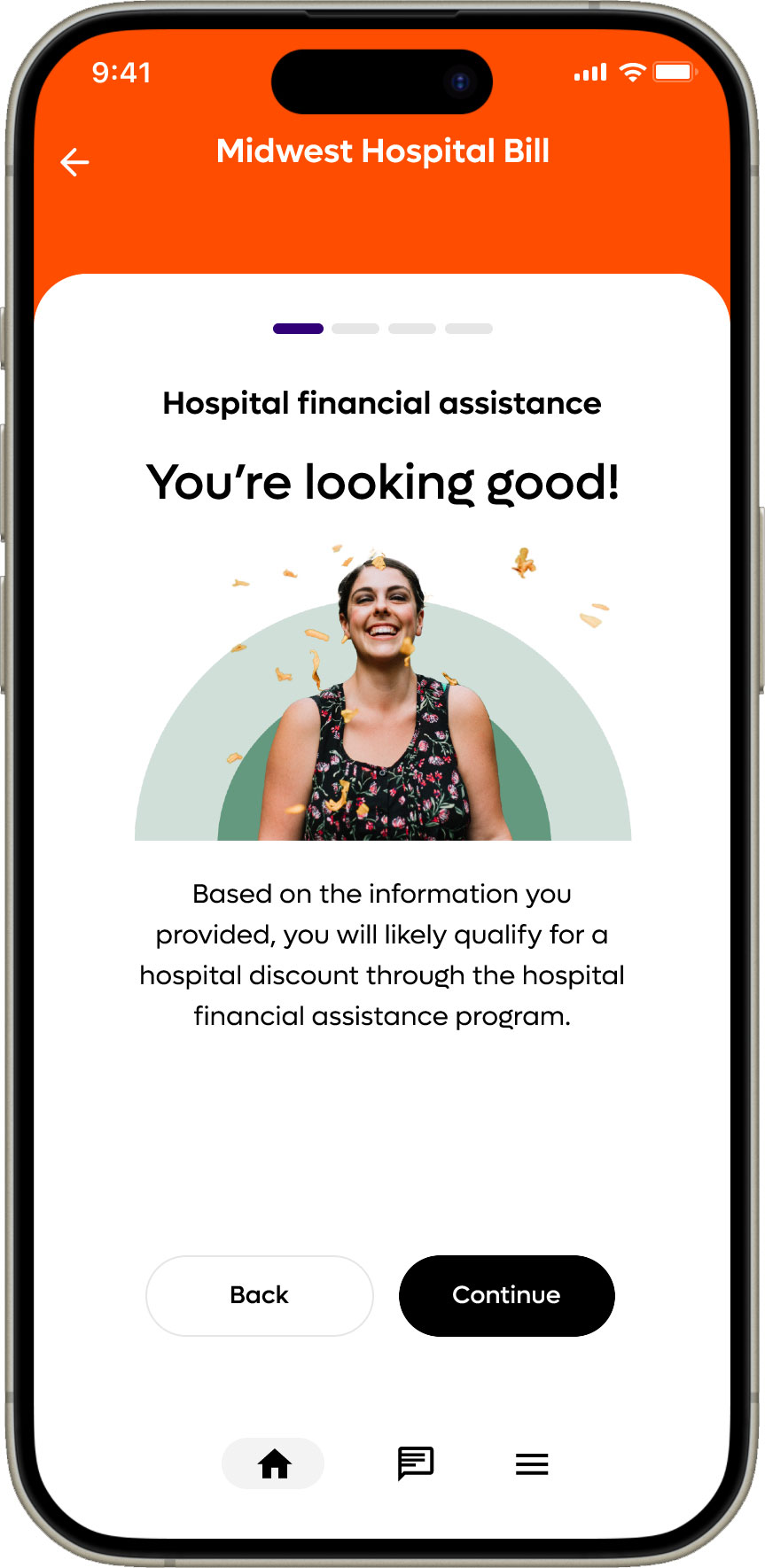

Advocacy + Bill Clarity

Our advocates review bills, negotiate savings, and guide employees to resolution.

Simple, Flexible Payments

Employees can pay in full for the highest discount or choose installments with 0% interest.

How It Works

Employer ROI & Member Savings

Discounts apply to eligible balances at partner health systems. Installments are always interest-free.

Backed by 5Star Life Insurance Company

- AM Best A– (Excellent) financial strength

- AFBA heritage founded with General Eisenhower’s support

- Licensed in 49 states & U.S. territories

- $2B+ in claims paid and $55B life insurance in force